Mowi will invest heavily in post-smolt production

The world's biggest salmon farmer aims to stock 40 million post-smolts in 2025, and is asking the authorities to better facilitate investments in Norway.

The first quarter of 2025 ended with increased revenues and results for Mowi compared to the same quarter last year, as a result of strong biological and operational performance, as well as higher volumes and lower costs.

"So far, 2025 has been a good year both operationally and biologically, which has resulted in high harvest volumes while at the same time we have never had more fish in the sea at this time," says Mowi chief executive Ivan Vindheim.

Mowi makes it clear in its Q1 2025 report that it wants to further step up investments in post-smolts, especially in Norway.

40 million post-smolts

In its quarterly presentation, Mowi highlights that a total of 40 million post-smolts will be stocked during the year. This corresponds to a coverage rate of 25% globally, and a full 50% in Norway (excluding the North Region).

"Increased release of smolt on unused licences and increased productivity through the use of post-smolt on utilised licenses is a key to further growth," the company writes in its report.

According to chief financial officer Kristian Ellingsen, there is already great progress in project development.

"Mowi wants to invest even more in post-smolt, and in Norway we have several projects we want to realise," he tells LandbasedAQ.

He points out that political predictability is crucial for investments.

"We hope that the framework conditions (in Norway) will facilitate this type of investment even more, and that the authorities will move away from a path where they will collect increasingly more taxes and fees," he says.

"Instead, the industry should be allowed to invest in post-smolt and other improvement projects. The industry must be given time to demonstrate that these measures have positive effects."

Long-term goal is minimum of 700g

The post-smolt percentage in Norway is growing, especially in Mowi's Southern, Western and Central regions, where it is now 50% post-smolt. According to Ellingsen, a minimum of 700 grams is the target for future releases.

"Smolt sizes have increased in recent years, and globally the proportion (for Mowi) is around 25%," he says.

The first batch from Mowi's new Haukå post-smolt facility was stocked in sea sites at the end of the first quarter. The facility is divided into four sections – two for smolts (RAS 1 and 2), and two for post-smolts (RAS 3 and 4).

Here, the fish grow from ova to nearly 700–800 grams before being stocked into the sea, significantly larger than in traditional smolt production.

Reduced mortality and 200 fewer days at sea

Mowi believes that larger smolts provide clear advantages both biologically and economically.

"This results in improved survival, fish welfare, diet and productivity. Larger smolts result in approximately 200 fewer days at sea, with the potential for halving mortality per cycle," says Ellingsen.

In addition, the company estimates around 40% fewer lice treatments, which contributes to better fish welfare and lower cost per kilogram.

"An important part of the volume increase that we realise in 2025 – and which comes on top of the good growth we have had in recent years – is due to post-smolts," he says.

A different path taken by Mowi Scotland

In Scotland, Mowi has made great strides with its post-smolt production in Loch Etive, a sea loch with low salinity that keeps lice numbers low.

There, four sites have been established and are fallowed altogether twice a year – a practice the company believes has led to clear biological improvements.

Going forward, an annual production of around 7 million post-smolts is expected from the area alone.

"Post-smolts reduce summer-related water quality challenges and results in lower mortality," the report states.

Multiple technologies

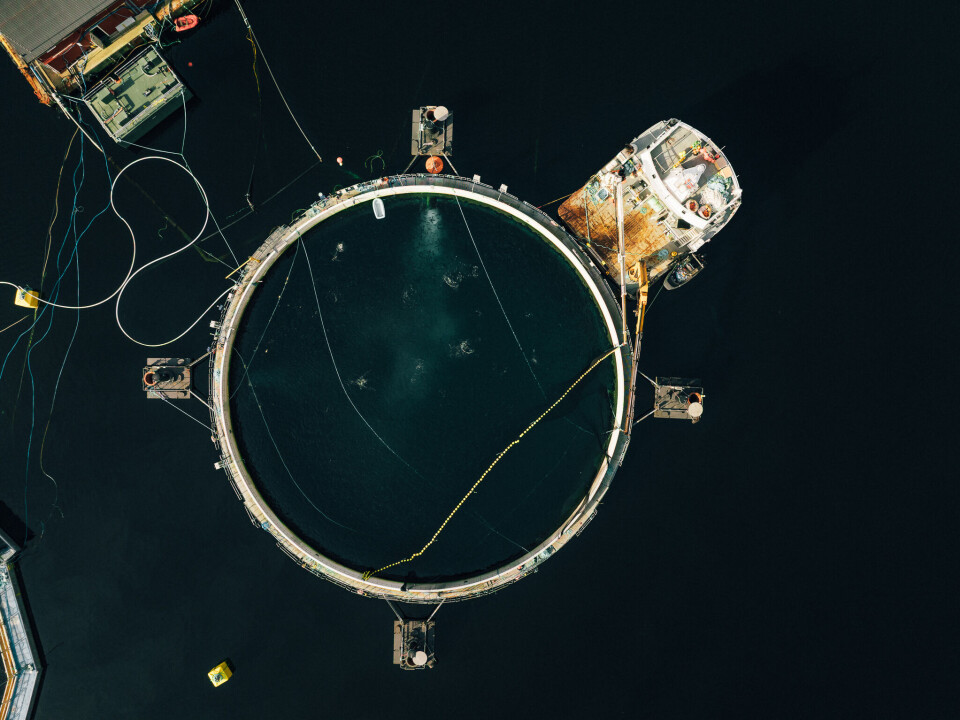

In addition to land-based facilities at Haukå, Fjæra and Nordheim, Mowi also uses floating closed containment systems. The company states that several technologies are in use and that its strategy is technology-neutral.

"We operate post-smolt production in closed facilities at sea, and have experience with several types of technologies. We focus on what we have the most confidence in at any given time," says Ellingsen.

He emphasises that the company is not locked into one solution.

"We don't want to be specific about individual concepts. As we see it, closed technology is not ready for full-cycle production yet, but it certainly has something for post-smolt production, especially in some areas."

In the regulatory area, he points to opportunities that can free up capacity.

"While the (Norwegian government) aquaculture report contains many radical proposals and claims, we still hope it will be possible to establish schemes that allow farmers to use reduced capacity in red areas (under the Traffic Light system) – for example with closed technology in the sea, where we have good experience with post-smolts," he says.

'We will do more of this'

In parallel, Mowi is building a new broodstock facility in Ardessie, Scotland, with a planned start-up in the third quarter of 2025. This will produce eggs from Mowi's own strain, known for its robustness and lower mortality.

The company states that this will strengthen both biological and economic performance in the long term.

For Mowi, post-smolts are a measure that links financial goals with biological and environmental considerations.

"Post-smolt is an area where financial goals and sustainability considerations, including fish welfare, go hand in hand. So we want to do more of this," concludes Ellingsen.