Kingfish Company revises break-even prediction by 'one or two quarters'

Yellowtail farmer increased sales volume in H1 but losses also increased

Land-based fish farmer The Kingfish Company has revised its forecast for achieving an operating profit by “one or two quarters”, and now expects to get into the black in 2026 instead of this year.

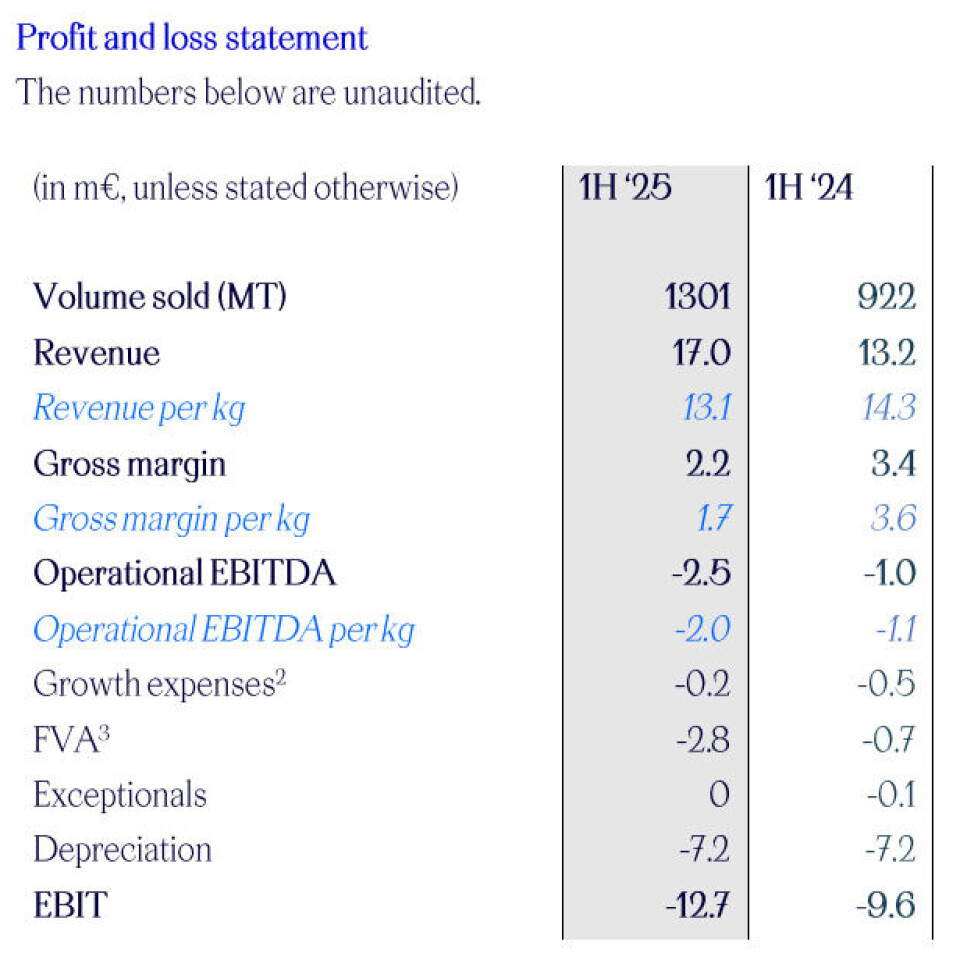

The change follows a first half of the year in which the Netherlands yellowtail farmer saw sales volume increase by 41% year on year to 1,301 tonnes, but operational EBITDA fall to €-2.0 per kg (H1 2024: €-1.1 per kg).

Revenue rose by 31% to €17m from €13.2m in H1 2024, primarily driven by the higher sales volumes, reported the company.

The average revenue per kilogram was temporarily lower at €13.1, down from €14.3 in the same period last year, which the company said reflects the impact of targeted promotional pricing and a higher proportion of frozen product sales to reduce inventory levels.

Lower margins

Gross margin was halved to €1.7 per kilo compared to €3.6 in H1 2024, with the reduction mainly explained by the lower revenue per kilogram and temporarily elevated farming costs due to a higher feed conversion ratio (FCR).

The higher operating loss of €-2.0 per kilo was driven by the lower gross margin partially compensated by a reduction in non-production costs per kilo as a result of higher volumes, while at the same time making significant strategic investments in commercial capabilities.

“We are pleased to report another period of strong volume growth, driven by rising demand for our sustainable yellowtail,” said chief executive Vincent Erenst.

“The performance in the first six months validates our commercial strategy and the strength of our market positioning. After earlier challenges with high biomass levels in the farm, we have now reached a balance between production and sales volumes, and farming conditions have normalised. These improvements are laying a solid foundation for margin improvement and long-term value creation as we scale.”

US pause

The company said that in light of the further increased import tariffs, an unfavourable US dollar exchange rate, and elevated logistics costs, it has decided to scale back commercial activities of fresh yellowtail kingfish in the United States, which account for approximately 6% of total fresh revenue.

It will continue the sale of the US frozen product portfolio.

“While we view the US as a strategically important and attractive market, current conditions do not support profitable operations,” Kingfish wrote in its H1 2025 report. “We will monitor developments closely and revisit our commercial approach once the economic environment becomes more supportive.”

It said its long-term commitment to the US market remains unchanged, supported by its fully permitted project for an 8,500 tonnes per year land-based facility in Maine.

Optimal levels

Following the biomass reduction measures implemented earlier this year, the company’s farm in Zeeland, Netherlands, is now operating close to optimal biomass levels. As of June 30, 2025, total standing biomass was 972 tonnes, down from 1,118 tonnes at the end of December 2024.

“The current production batches were stocked during the period when growth-limiting measures were in place, and, as a result, these fish remain on a lower growth trajectory and are performing below standard benchmarks,” wrote the company.

“While FCR improved from 1.9 in Q1 2025 to 1.6 in Q2 2025, it remains above our target. We continue to implement measures aimed at improving biological performance and expect FCR to return to normalised level by year-end.”