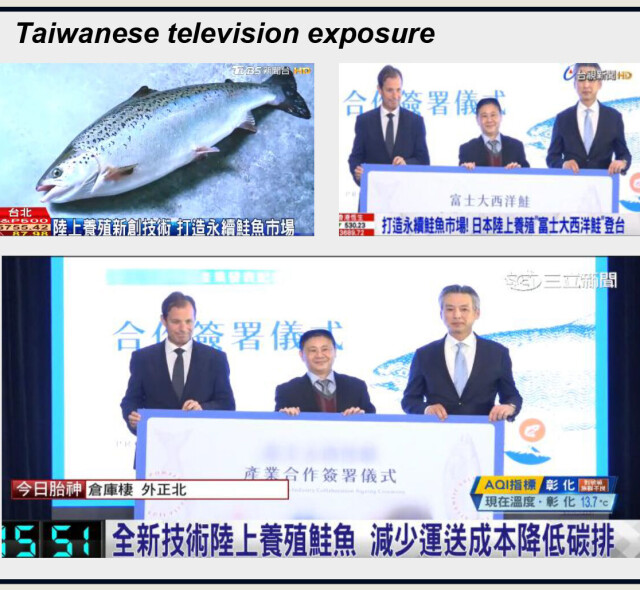

Proximar has exported fish to Taiwan

The land-based salmon farmer located in Japan is focusing on a broader regional expansion strategy. Its has sold salmon to Taiwan, and biofilter challenges should be adjusted during June.

Proximar Seafood harvested a total of 322 tonnes (head on gutted) during the first quarter, with a superior share of 99.5%. According to its Q1 2025 report, it achieved a premium price for the fish entering the market.

As of May 6, the company had harvested a total of 450 tonnes HOG.

“Our products are attracting great interest throughout Asia, with exclusive buyers in both Japan and, more recently, Taiwan. In June, our grow-out facility will be fully operational,” writes Proximar chief executive Joachim Nielsen.

The company says it remains the only local producer of Atlantic salmon in Japan, and recent exports to Taiwan mark the start of a broader regional expansion strategy.

In Japan, Norwegian-owned Proximar already has a long-term distribution agreement with Marubeni Corporation, one of Japan's largest trading houses.

Biofilter will soon be 100%

According to the company, the fish still have a very good health status, with survival rates above 98%.

The standing biomass reached 1,126 tonnes (live weight) at the end of the quarter (1,249 tonnes now), but growth rates have been affected by previously communicated challenges with the biofilter.

In June, all repairs to the biofilter will be completed, and the growth facility will be back to 100% utilisation.

"When all modules are back in operation, it will also enable more efficient sorting of the fish going forward, which improves size distribution," the company writes.

The company says that it has claimed compensation through business interruption insurance to compensate for the costs associated with lower harvest volumes and associated consequences.

Proximar reports that it has had no problems with geosmin so far. It conducts regular checks of geosmin in both water and fish, and continue to purge according to plan to ensure quality.

Highlights for the first quarter of 2025:

- Weekly harvest volumes continue – 322 tonnes (HOG) harvested in the quarter.

- Good price achievement, with an average price of 97 NOK/kg, and larger fish (>3kg) with an average price of 118 NOK/kg.

Average harvest size is expected to increase gradually through the second half of 2025, as feeding resumes and all modules are fully operational.

- 99.5% superior rate, survival rate above 98%.

- Strong market reception is reported – continued high demand from exclusive restaurants and first exports to Taiwan in March.

- Additional financing secured, with short-term loans and credit facilities totalling ~45 million NOK to cover working capital needs (another NOK 22 million secured in April).

- Biofilter repairs are nearing completion, and full capacity in the grow-out facility is expected in June.

Outlook for 2025

Production ramp-up and positive profit development will mark Proximar's first full year of commercial operation.

With biofilter repairs completed in June, and harvest weights expected to increase throughout the second half of the year, the company reiterates its belief in the original business plan and long-term production target of full-scale capacity of 5,300 tonnes HOG in 2027.

According to the company, the plant has been completed with a capital expenditure of approximately NOK 240 (£17.37 at today's exchange rate) per kilogram.

Outlook:

- Harvest volume for 2025 is expected to be ~3,000–3,300 tonnes (HOG), with ~750 tonnes in the first half of the year.

- EBITDA for the second quarter is expected to be around zero; full annual EBITDA forecast will be communicated in Q2.

- First insurance payment for biofilter repairs received in April.

- Further handling of business interruption insurance and claims to compensate for business interruption.

“While short-term volumes have been impacted by known operational challenges, our underlying conditions remain very attractive. Import prices consistently above NOK 100/kg allow us to deliver strong margins, having proven the quality, system performance and market relevance of our product,” writes Nielsen.